Hello Everyone! Thank you in advance for reading this. It’s long but I’d really appreciate any and all advice as I am over my head and scared.

I have recently become the trustee to my mother’s trust after a little over a decade of having another family member (whom we’ll call Sara), quietly pass on the duties to the co-trustee(whom we’ll call Bob), who has little to no idea as to what he’s doing. I have shown and verbalized my interest in becoming more informed and involved in our trust over the past several years but it was always sort of brushed off.

Nonetheless, after discovering that the Trustee duties had been passed onto the other Trustee, I was able to dive in head first, despite Sara’s apparent wishes. I can only assume this is due to extreme maleficence taking place over the years and her fearing that I was more likely to catch on than Bob would. After almost a year since Bob was left in charge, I have FINALLY become a Trustee. with Bob still listed as Co-Trustee.

At the time Sara decided to transfer responsibility onto Bob, she provide him with one box of paperwork. Most of which I have ultimately deemed irrelevant. There were a bunch of appraisals, one year’s tax filing, just one. A list of wells by county that gave reference as to where this information was listed or retrieved from, the previous years paid tax receipts by county and a whole binder of Quit Claims Deeds that were recorded in each county when the assets where transferred from the Estate to the trust… 90% without any description listed under Exhibit A.

We, as beneficiaries were never given an annual accounting over the 10+ years that Sara was in charge. I even asked her to provide us with one, or all of them about 4 years ago; and she stopped talking to me for 2 or 3 years. She only recently started speaking to me again upon finding out that I was handling things now. Additionally, we have never been provided with any deeds, copies of leases, titles, or, division orders.

I spoke with and hired an Estate Attorney in my state (which is not one of the states we have property in, or oil for that matter) about the lack of information provided to us and her lack of transparency throughout the hand off and over all. We discussed the idea of having Sara resign in order for me to take over as Trustee. She told me that having Sara resign wouldn’t release her from liability if we were to discover malfeasance or theft, it may release her responsibility to procure the documents and paperwork we want and need to be able to assess and manage the trust’s assets. The plan at that time was to send Sara a Demand for all ownership documentation, accountings, etc. and if she didn’t respond, bring the matter before a Judge.

Ultimately, I chose not to proceed with that attorney as she seemed far to busy as it was and she didn’t have any knowledge or experience in Oil & Gas anyway. Since then, I have been doing as much research as I can on my own in an effort to assess our assets from the trust’s origination to today so that I can have an idea of what we need from an attorney. Aka, I have not had any legal counsel to advise me or my decisions. Here in lies my dilemma:

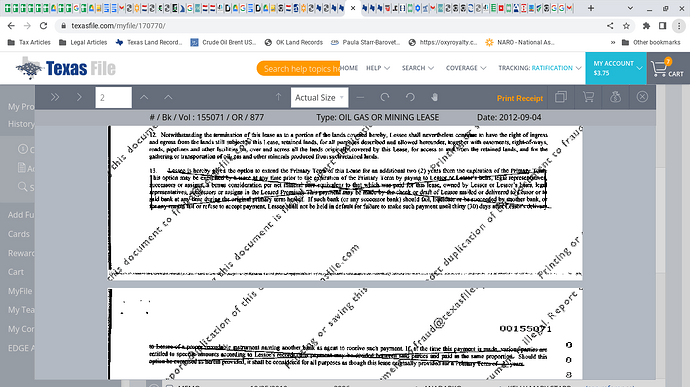

I knew my aunt wasn’t going to give us the paperwork we need. Sure, we could go in front of a Judge who might make her come up with it but she’s old and she could probably draw it out long enough that I’m better off obtaining it myself. (i.e IRS past filings request, contacting the accounting firm she used, running title, Texasfile.com, bank statements, etc). At this point, I was at a standstill because I was the only one searching for information, yet I was not a Trustee. (Let’s just say, I’ve been doing A LOT of emailing when phone calls would be soooooo much easier.)

So I decided… I need on the trust. I have enough information to know that she has not managed our trust with our “best interest” in mind, at all. She has sold our properties without consulting or informing us, negotiated lease agreements and bonuses while omitting the monetary value of said agreements from the record books and I am 90% certain she has been funding the trust account she turned over to us, from another account.

She had to go.

Sure, I could have been added to the trust along with her. But I just wanted her gone. I sent her a resignation of trustee document with an amicable email saying thank you, bye, bye. She promptly returned it, I took it to the bank along with my appointment and acceptance and the new COT. Boom! I’m on the trust. She’s off. Phew…

Not so much. Yesterday, I run a search by county on Texasfile and just one week after signing her resignation; she filed a bunch of stuff regarding my mother’s estate in just one (so far) particular county. There’s an acceptance, an appointment, an affidavit of heir, PROBATE… Probate? My mother died 14 years ago…? How is there still probate being filed??? There’s also a Release and a Letter of Testamentary???

I AM FREAKING OUT??! What does this mean. I obviously need to hire a lawyer, like yesterday… but given what’s left of our mineral rights; we can barely afford one. Which means I need to sell some of our rights first to come up with a decent retainer fee! I don’t even know how long it takes to sell and I don’t know which ones to sell.

But in the meantime; my real question is: what the heck is she up to? I can only assume that she left some assets out of the trust and kept them in the Estate so now she’s accepting her role as PR of the estate and sealing the estate with those assets under her name?

I feel like I caused this by letting her/asking her to resign?! So far only one county has shown up like this but are the others ones being processed as we speak? What does this mean? And without a lawyer on the ready and in the know, do I even stand a chance at intervening or stopping this from happening?

I’m scared, stressed, and feeling like a fool. I need all the help I can get. Where do I even begin?