Family has property that is part of a horizontal drill. The well was drilled a little over 1 year ago. 05/2015

Crude production has gone from over 7000 bbl per month to just under 1000 bbl per month.

I poked around and noticed that several of the wells owned by Sabine Oil had their production go down dramatically at almost the same time. Coincidence?

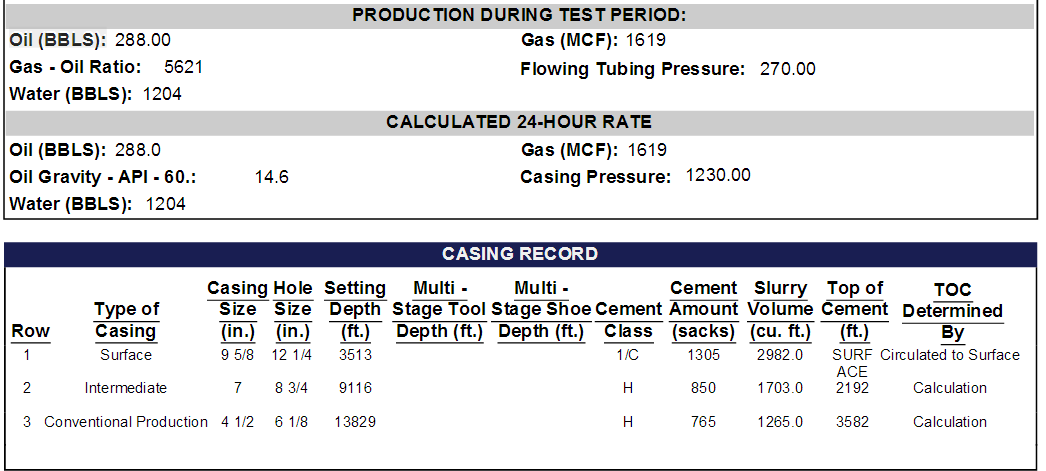

Initial potential was 288 bbl per day with a choke size of 128/64.

Honestly I don't know much about the choke size, or the life of a horizontal well?

Would Sabine have the ability to cut back on production? I know that they just emerged out of bankruptcy. I don't know if this would influence the amount of production they were showing on the books. Any thoughts or comments are greatly appreciated.

RRC Lease No.:15425 if needed.

Early declines are usually due to physics; pressure relative to volume. However, Sabine has proven reserves of a significant nature in the well or what you can consider inventory. Sabine can now use the well to pay the game of supply and demand relative to price.

Answer: All wells decline naturally and operators can also control production to meet their business needs wishin the physical well constraints. Save your royalty checks for 4 years then take control of that money. That is what you can control as a lessor.

Gary L Hutchinson

Minerals Managment

I think 128/64 would be a 2 inch pipe, effectively no choke? I am more used to seeing numbers like 28/64. Out of curiosity, how much gas and water was produced? The amount of gas produced can be a rough indicator of pressure.

Hopefully the information below will answer your question. Any insight is appreciated.

Oil