New here.  Have been getting some requests to buy mineral rights. The last time that happened, activity happened and we were glad we did not sell…although that is really not something we will do anyway. Wondering if there is something going on in the county that we are again receiving letters to buy. It is kind of hard to know how much and for how long the checks will last to know how to plan. That is the reason for the question. Thanks for any info you may be privy to.

Have been getting some requests to buy mineral rights. The last time that happened, activity happened and we were glad we did not sell…although that is really not something we will do anyway. Wondering if there is something going on in the county that we are again receiving letters to buy. It is kind of hard to know how much and for how long the checks will last to know how to plan. That is the reason for the question. Thanks for any info you may be privy to.

Had this under general, but saw it should be under more specific category…couldn’t find how to delete original post.

My cousins and I have also received recent offers to buy our rights. Don’t know the cause, but I suspect it’s because of permits issued to drill more wells. Our first offer had an incorrect amount for the mineral rights we own. Sloppy work. They did cover themselves in the offer, saying that if they determined the amount in the offer was incorrect, that we had to agree to their changing the amount of acreage owned.

Hi Ed and thing thing,

I just received an offer to buy my mineral acres in the same section that you have Ed. Offer was from Incline energy partners. Is that who made an offer to you?

I’m not sure what a reasonable offer is. Any thoughts?

I’ve been away from this site for awhile. Good to see it up and running.

It is more helpful if you state the complete section, township and range. There are many section 28s in McKenzie.

28 151-n 098-w.  Thanks. Did not realize that. Kind of an ignoramus in the details of all this.

Thanks. Did not realize that. Kind of an ignoramus in the details of all this.

No problem. Most of us think local and “our stuff” until we realize that we are part of a much bigger picture.

There are quite a few wells that go into your section. The Forland well from 2012 which is still online. And the rest of the Forland and Rolfson wells from 2017. Some drilled from 29 into 33 and some from 33 into 29 and some from 4 into 29. Those companies want to buy your remaining production. As you have probably seen, the checks start out quite large in the first year or two. The decline sets in immediately at a fairly steep rate. Very natural. The wells will continue to decline over time but the steep decline will lesson. These wells may stay online for decades at lower rates.

If you really want to know what the wells can produce, you can get a certified petroleum engineer to evaluate your wells and give you a discounted cash flow report. They will run the engineering on each well and then give a fair market value report. Then discount it for the time value of money and you will have a fair idea of what to expect. They usually run it at one price set point, but they may be able to do a range. Not sure there will be more drilling on your acreage unless into different benches.

I have acreage near you and just had the engineering done. I will hold onto our acreage.

Yes, Lon, the offer was from Incline. Another company called a cousin who shares in the same area as i have. They said they would send her an analysis of our area, giving its market value. Now, why would they do that? Hopefully, whatever she is told might give us some idea as to the value of our land. I’ll keep you posted, should I learn anything.

Thanks for this information.

When I get multiple offers, someone knows something that I don’t know and they are pretty sure they are going to make a profit off of whatever they offer me. So far, where I have producing wells, my engineer’s reports have indicated that holding on was much more prudent than selling. Other folks may have different opinions.

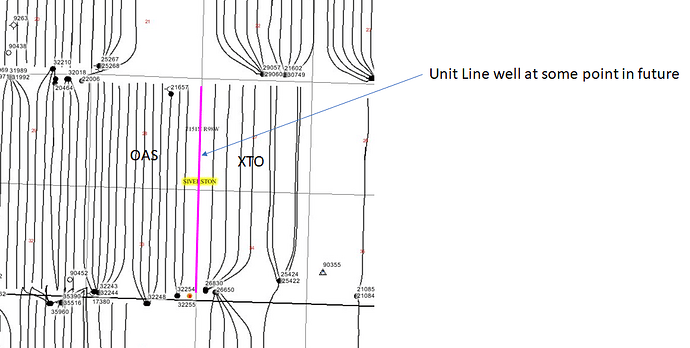

I seriously doubt you are getting more wells in Sec 28. At some point XTO will drill the unitline well between the 27/34 and 28/33 units, but that is pretty much it for potential new wells. Oasis already killed it in both Middle Bakken and Three Forks across 28/33.

If you are wondering why the XTO wells are spaced so oddly its because nobody would listen to their engineer.

Now two wells being drilled, 6H and 7H as I recall, and one in LOC status. The excitement builds!

![]() Have been getting some requests to buy mineral rights. The last time that happened, activity happened and we were glad we did not sell…although that is really not something we will do anyway. Wondering if there is something going on in the county that we are again receiving letters to buy. It is kind of hard to know how much and for how long the checks will last to know how to plan. That is the reason for the question. Thanks for any info you may be privy to.

Have been getting some requests to buy mineral rights. The last time that happened, activity happened and we were glad we did not sell…although that is really not something we will do anyway. Wondering if there is something going on in the county that we are again receiving letters to buy. It is kind of hard to know how much and for how long the checks will last to know how to plan. That is the reason for the question. Thanks for any info you may be privy to.