Hi all. New here and struggling to understand how to gauge whether an offer is fair or suspect.

First things first. We received this information from the gentlemen wanting to purchase the deed.

“You and your sister inherited a 1/8 Non-participating Royalty Interest in two 40 gross acre tracts, being a total of 80 gross acres: One tract in South One-Half of the South One-Half of the North-East Quarter (S2/S2/NE/4) of Section 53, BLock 2, H & T.C. Ry. Co. Survey, Fisher County, Texas…AND…the other being in the North One-Half of the South One-Half of the North-East Quarter (N2/S2/NE/4) of Section 53, BLock 2, H & T.C. Ry. Co. Survey, Fisher County, Texas.

Basically, this means that you and your sister both inherited a one-eighth (1/8) out of a total of 80 gross acres in this section, giving you a total of 5 non-participating royalty acres each. The “non-participating” part just means that you are not required to pay into a well if it is drilled. “

It goes on to explain:

“ > > I have attached some well data for the surrounding sections;

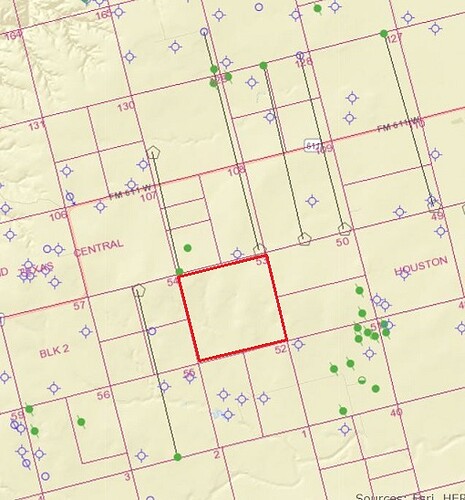

The first attachment is a map of section 53 and surrounding sections. The solid green dots are active wells. The green dots with the line through it are plugged wells that are not producing. The open blue circles are dry wells.

The lateral well that was drilled in section 56, to the southeast of your interest, started out as a good well, but has taken a huge dip in production. The attachment shows how many barrels per month the well has produced (the number on the left).

All of the wells in section 52, were “dry-holes”, meaning that they are not producing sites.

The wells to the east and southeast in sections 50 & 51 are either plugged wells (meaning they aren’t producing enough for profit) or they are dry holes also.

(I KNOW THIS IS A LOT SO PLEASE, BEAR WITH ME!!)

The wells to the north of your interest are averaging about 80 barrels/day. This may seem like a lot, but generally in order for you to see any substantial money back from these production values, an average good well will produce AT LEAST 400-500 bbls(abbreviation for barrels of oil) per day.

When a company drills a well in this area, it is costing between $5-$9 million. These drilling companies can require that they receive 60% of their drilling cost returns before you ever see a check (IF they ever actually drill on your property). Which means that at that lower production rate, it can take up to a few years for you to even get paid on the well.

Give me a call whenever you get back and I can walk you through the railroad commision website, if you would like and further explain things.”

This just seems suspect. So far the person has been very pushy and wants to make a deal on a short timeline.

Any advice or recommendations on what to look into. No one comes out of nowhere and just tries to buys something from you “with no real value” if there is t a catch.

Thanks in advance

Max