It depends on your situation. That purchase offer is 2-3 times what we have received as a bonus payment to lease (not sell) the property mineral rights. Then if they drill after leasing of course you also receive royalty payments on the production. So in our case we have not sold any of our mineral rights but instead choose to wait for them to be leased which could be never. Your situation, your choice.

I love the expiration lol. Dont worry about that as they will always buy it after expiration, they are just trying to rush you. As for price, I’d get another offer to see if you can get it higher - mineral companies love the unleased acreage like this

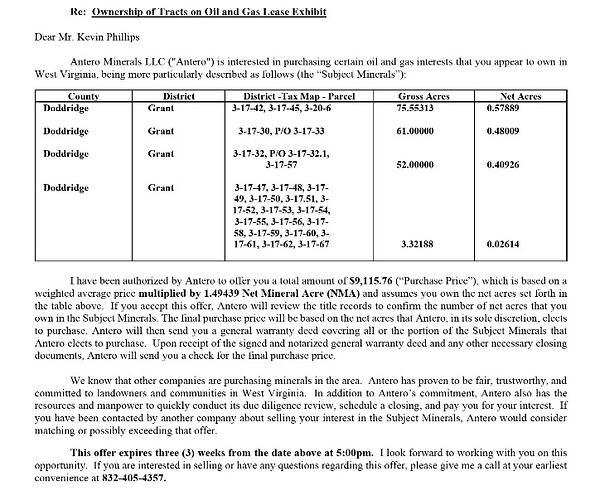

Yeah I think you could get more than that. I just looked you up and it doesnt seem like you have a lease on file, thus the property is more valuable. Definitely check in with another mineral company as they LOVE unleased acreage. I wouldnt sell or sign any leases until you check with others as Antero has a habit of making you sign a lease with terms in there that kills the value of the acreage (e.g. Right of First Refusals clauses)

But there was no Right of First Refusals clause on that lease.

@KAPNKAVEMAN I just looked at the lease you have filed in Doddridge, and unless you specifically negotiated it out, Antero always puts those clauses in in post-2018 leases. I see it in yours as it is clause #7 in the lease that gives them the Preferential Right to Purchase. I’d definitely get another offer though if you are seriously considering selling it especially if Antero is interested after just leasing you up in December