I inherited minerals rights after my father passed in 2007. We currently have a lease and received correspondence that they are about to begin drilling. We have pooled interests (640 total acres) in sections 17 & 20, 14N, 6W. I received multiple offers and the best, by far (about double the others), was from Ferrell Oil Co. I was thinking about selling half of my 26 acres, as is my sister. I saw one lady had a bad experience with them but everything else I have found seems positive.

-

Has anybody had any prior business with this company?

-

Does anybody have advice as to whether or not selling rights is favorable or will I be able to expect a better return if I hold them? From what I’ve read on this site, the adjacent sections to ours seem to be producing between 2-5 mcf, but I can’t seem to figure out what to expect as a royalty. We have 3/16 royalties.

Thank you in advance for any help you might be able to give us.

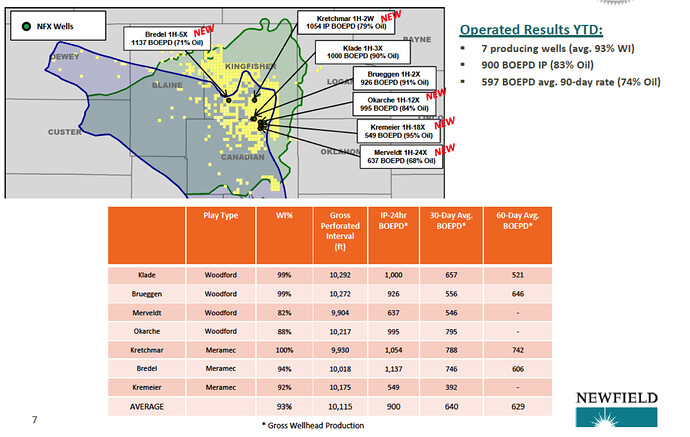

If I were you, I would pass. I believe you can expect a better return by holding and collecting your royalty payments. It is of course speculative before drilling, but your ownership interest could develop into a long term winner. If you haven't already done so, research Newfield, Meramec formation, and the STACK.

I come from a background of "never sell your minerals", and we are on our fifth generation or more of benefit from that mantra. Quite a bit of drilling is about to start in your area. Most of the companies will hold a section with one well and then come back in later for additional drilling if it makes sense. I would suggest that you read the Cimarex investor presentations as well as those by Devon and ones listed by Ricky. If you are getting offers, it is because something is about to happen and they are not going to offer you full value. (I have been in the business for 30 years, so I am familiar with those low offers and why they do it.)

I attached a spreadsheet where you can do some calculations and see what your options are. Cimarex and Devon are drilling 9-10 wells per section in 13N-9&10W. Not promising they will do the same in your area since the Woodford is a bit thinner, but it is also not the only reservoir. See what the long term royalty payouts will be. The spreadsheet is for four years, the highest of the paying years, but these wells can last for 20-30 years-so this can affect generations. Read up on the area. Read the forums, get knowledgeable. Newfield has another play in the Meramec about to bust wide open in this area. I am not selling my acres, but you have to decide what makes sense for you.

2142-NMACalculationsimple.xls (43 KB)

Thank you guys so much for your info. I will research the links you suggested. Do you have an idea of a time frame that royalties would start being paid? I got the letter with their drilling application in October. Could use some income with my situation right now.

I was told by aunts and uncles that there were previous oil wells that dried up some time ago and they’ll only be drilling for natural gas. Of course, now that we’re pooled, we have more acreage to drill in. I can’t seem to find a map that shows actual sections w/numbers. On this map, from the Cimarex investor site, it looks like there are a lot of non-operated wells. Can anybody tell me where on this map my rights are located? Sections 17 & 20, 14N, 6W.

Would that mean the non-operated wells have been used up and maybe won’t produce? If my sections are located in those areas, would that mean gas is all I should expect to receive royalties from? I ask because it seems that the real value is in oil and not gas. Just trying to gauge my probability of long term dividends. Thanks again.

2141-image.jpg (147 KB)

The more important presentation that you should look at it the Newfield one. Your acreage is the next sections to the east of the Kremier, Okarche and Merveldt wells. This is why they want to buy. This is Woodford with the Meramec new play on top of it. You will probably not see royalties for about year. These numbers are in barrels of oil equivalent. The numbers you can plug into the spreadsheet are from the completion reports.

Kremeier ah-18X is 286 bbls oil 398 mcf gas per day

Merveldt 1H-24X is 308 bbls oil 1314 mcf gas per day

Okarche breakout not listed yet. but it is even better.

If I were you, I wouldn't sell a single acre! (Friend me if you want a more complete explanation)

Read this whole presentation. From the Cimarex map, you are two sections over to the east of that map. Newfield is known for drilling multiple wells. They will probably drill one well to save the block and then come back later to drill more. No promises, but their general pattern in the SCOOP area to the south.

http://www.newfield.com/assets/pdf/Jefferies%20Energy%20Conference%202013.pdf

I read a few of their presentations too, as well as Devon’s, and it does look like there might be oil in the area. Wasn’t sure what I was looking at really and don’t speak oil/gas language when it comes to the figures and all the abbreviations. This is confusing as I get started reading everything, but I am extremely grateful for all of your help. The calculator on Excel is hard to understand but I found a calculator online at shalebiz.com that seemed easier to input. I was showing that if we got 500 barrels at $90 per, 3/16 royalties for 26/640 acres, I would get around $116K per year. Does that sound like reasonable input numbers of what to expect for production and/or income?

Somewhere in that range. It will have gas with it as well, so closer to $125,000 if you use 500 bbls (estimate only) and just for the first year. These wells decline rapidly for the first four years, then can hang on at a very low rate for 20-30 years.

Most definitely oil in the area! If you scroll down on the excel spreadsheet to line 28, you can input your acres and see how much they would have to offer you per acre to make it worth your while to sell. Put in your acres on line 4, 7 & 28. Spacing is 640. Input the royalty rate in column D and the bonus rate that you chose at pooling.

Input 300 bbls oil and 500 mcf gas since that is pretty close to the two nearest wells. 500 bbls is probably a little too high for this area. My quick calculations show that it would have to be at least $8000/ac offer to buy to end up with more money after 4 years with one well. $16,000/ ac it there were two wells. I doubt they will offer that much! These are only estimates, but you can see the impact for just four years, not to mention 20. If you really need cash, maybe just sell 6 acres and keep the rest. Balance the risk, because it does have risk. You have to do what you think is best. But get as informed as possible first.