Without knowing the location of his minerals, making a statement that it’s not “unusual” to get $25K per acre is rather ambitious. Similar making a statement that “once you hit $30,000 per acre” you should take a closer look. I think the hype needs to settle down a little, and everyone should remember the much praised “checkerboard” play doesn’t cover the entire county. Furthermore, the formations do not blanket the entire county either, and the depth changes drastically east to west. So while the enthusiasm is justified for some fortunate mineral owners that are located in places where you may get $30,000…or more, the reality is that is not ‘unusual’ rather the “exception” when taken in context with the larger picture.

Values in Grady, or any other county (Blaine, Canadian, Kingfisher) vary widely due to location, it is real estate after all. Not every property has a Park Avenue address.

As an example, south western Grady is not very attractive, other portions of Grady are attractive. Prior to deciding whether an offer is good, bad or indifferent, take the time to look into what’s going on in your SPECIFIC area. Broad generic assumptions will make the old saying about assuming become reality. Any buyer is buying based on their analysis and in an attempt to make a profit - hard to phantom anyone making an invest to intentionally lose money (yet some people seem to have the knack for over paying).

And I’m sure people will state - Oh but wait, continental said they plan to make 4X on their mineral acquisitions. Yes they might have, but they are armed with a drilling schedule, know where and when things are going to be developed and haven’t stated what the holding period for their invest will be. Additionally, they liquidated all their hedges because oil was never going to go down for long…so, maybe consider that public companies might embellish just a little..

In summary, depending on where in Grady, you could have an asset worth $25 or $30k/acre, or an asset worth $200-$300/acre. As I said, it all depends and values vary significantly.

As far as capital gains, if you look at the changes to the tax rules, cap gains rates very, and depend on ordinary income. I don’t think making a profit/capital gain should be a huge deterrent to doing a deal, and you maybe able to utilize a 1031 exchange to defer some of the cap gain.

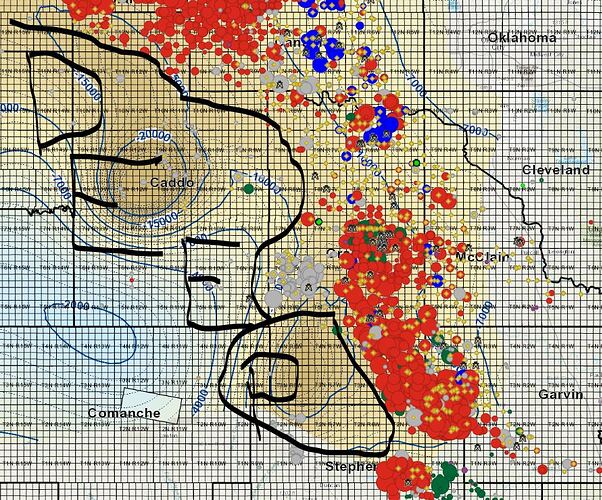

the following map highlights some of the variance throughout Grady. The size of the bubble is based on the first 6 months BOE, as you can see there are portions of Grady that have no real HZ development as the basin plunges in depth. Additionally, as you move east, the formation become more shallow quickly. These changes in depth results in changes in production mix and well deliverability.

If you want me to take a quick look at a specific area, feel free to PM me the location, etc and I can give you some more granular details.