Hello, I have an offer to purchase 9.625 royalty acres in Reagan county. My question is how do I know what a good offer is? In my past experience someone only wants to purchase property if they have plans to develop or redevelop it. I feel like the offer is too low at $18,000 per acre but dont know if I should just say no or counter.

Welcome to the forum. If someone walked up to your door and wanted to buy your car would you take the first offer? Probably not. There are very sophisticated buyers out there with engineers, geologists and a line of site view to potential operators and rigs, so they hold the information that you do not have.

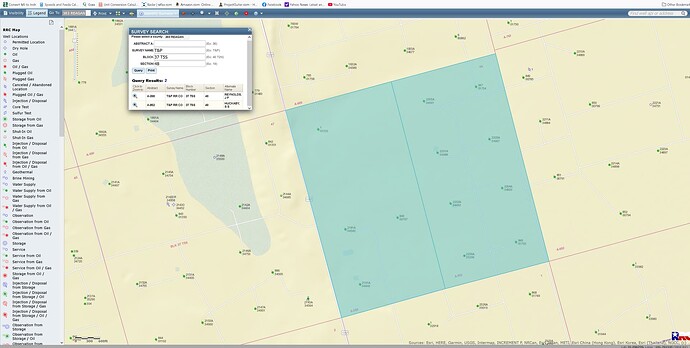

If you share your block, abstract and section, forum members can usually help you with activity in the area.

It is Driver unit TR 218 Spraberry T & P T5S N2SW4 A-, B-37, S-48 Sec 48 Blk 37 T5S Reagan, TX

Surrounded by production, hard to say when development will come…Double Eagle drilled a few wells 2-2&1/2 miles east, looks like they are producing 100K bbls and 200MMCF in the first five months; that’s roughly $7.5 MM if my calculations are correct which is about $2K/acre/well. Looks like they drilled 5 in the E2. All that’s to say $18K/acre doesn’t seem egregious when discounted, but if they came in tomorrow and fully developed your acreage you’d prob make that back and then some in 9-12 months.

Thank you. Is there any way to know if there are plans to develop?

Not really, call Exxon/Pioneer and ask?..but you’d prob get someone that doesn’t really know themselves and will tell you ‘whenever management decides to’. The only real practical way that I know is to check that pictured map over at the RRC and see if permits pop up; and, estimate 6-12 months more or less from the date the permits are approved. They will also prob send you something in the mail prior to drilling if you don’t want to monitor it.

I’m not sure what you are looking at. There are NO recent permits in either of the abstracts for the section you listed in your description. MK

Ok! Thank you! I had a lot of difficulty trying to figure out how to work with the map!

The map can be finicky, but your map is showing sections 16 & 21 which are listed in the top right corner…you are in the correct Blk and Township though

Laugh. Yeah there is zero chance you will get anyone at XOM that knows when anybody is doing anything except having a meeting or planning lunch.

My biased cynical take is that most of the time nobody trying to buy your minerals knows jack. They are just throwing out offers because they need to deploy money or because they know that when wells come online they can probably ponzi sell it @ $30k/nra to someone who needs 20% up front yield and doesn’t care that its only going to make $35k/nra overall. The joy of the Midland Basin.

$18k/nra there is pretty solid. If you keep if forever you will make more than $18k/NRA in cash flow. Forever is a long time.

Valuation is always difficult. If you need money today, then I would first get an independent evaluation and then present your property for bid with at least 5 mineral companies. You can go to Directories/Mineral Services to find a listing for Pecan Tree for such an evaluation. Tracy can provide you with an initial range at a fairly reasonable cost.

This topic was automatically closed after 90 days. New replies are no longer allowed.