Checking on lease offer terms from Gulfport for Stephens County: Herro 1-23X25H, Section 25-2N-5W. Lease offer terms are: 1) $1,600 nma with 1/8th royalty, delivering 87.5 nri for 3 year term; or 2) $1,350 nma with 3/16ths royalty, delivering 81.25% nri for 3 year term; or 3) $1,200 nma with 1/5th royalty, delivering 80% nri for 3 years. Anyone doing any better? Any negotiating room? Also, I’m not familiar with the “earnout” concept. How does that work?

Most savvy mineral owners would want the higher royalty since it usually far outpays in royalties over time with successful wells-especially if there are infill wells down the road. Always wise to have a good oil and gas attorney review the lease as the drafts are rarely in the mineral owner’s favor. Cannot comment on the “earnout” without seeing the whole wording. Ask the attorney.

I agree highest royalty is best. I don’t have the lease yet, just a well proposal offer. Prior lease offers typically reference “paid up” lease. “Paid up” isn’t referenced in this offer and the options offered include language such as “…reserving a 3/16ths royalty interest and delivering an 81.25% net revenue interest for a three year term.” The end of the sentence beginning with the word “delivering” is what I’m calling the “earn out”, but that is just my term. That passage is unfamiliar to me and I’m thinking it may be because the offer may not be a “paid up” lease. Ps - I appreciate your comment about getting legal review of the lease, but my annual income off these leases is only $200-$300, at best, due to diluted interest.

That language is common. Almost all leases are “paid up” now. I have not seen a rental lease in over several decades. The language is awkward, but it basically means that if a well is successful you keep 20% of the royalties and the working interest owners keeps 80% of the royalties for a 1/5th (20%) lease. What you have to watch out for in the lease is the post production charges which they will try to make you pay. Hence the need for an attorney to fix that clause and many others.

Gulfport has a very successful drilling program in this particular area. The revenue is likely to be much more than $200-300 since the wells are horizontal. There may be more than one well.

Gulfport is not the only company leasing in the area. Balco Energy is also leasing. You do not have to lease. You could wait for forced pooling which has its own pros and cons. Mostly pros in my opinion.

Are these just initial offers? Have you countered at all? There is ALWAYS room to negotiate. My first thought is to counter at $1600 and a 1/4 royalty for 2 year term. Ask for movement on all terms, they’ll make concessions somewhere.

Also, you stated your annual income off these leases are minimal, which is confusing because if you are receiving payment, these leases would be held by production, and not up for renegotiation of the lease. So is this separate tract you own minerals in that you have been approached to lease?

The lease may be held by production BUT there may be clauses that the lease can only hold producing formations or to a certain depth, etc.

25-2N-5W has no production currently.

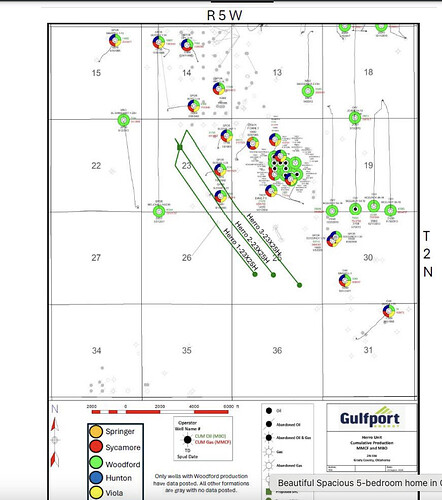

Gulfport has a multiunit horitontal well planned for 23,24, 25-2N-5W. Case 2024-003154. Well to be called the Herro 3-23X25H for the Woodford. Three wells are planned.

If you do not want to mess with leasing, there is a pooling scheduled with case 2024-003165. The hearing is scheduled for Nov 4. Time frame to drill is one year from the date of the Order.

Those should be some nice wells .

What advantage is there to a pooling process v. proceeding with a lease?

A lot of people on here think pooling is the way to go. I personally do not. If you get to the point of a pooling date, you should be getting calls from atleast 3-4 non op companies and can get better deals. To each their own, just my 2 cents

If I can get an excellent mineral friendly lease with good terms and a good royalty, I prefer that. Some operators will not budge, so then I like pooling as it is only for a six months to a year for a designated reservoir(s). In some cases, I have been paid multiple bonus amounts if the well was not drilled in the order’s time frame and was extended. Other cases, I have pooled different reservoirs on the same tract and received multiple bonus amounts over the years. Case dependent.

Hi, Marilyn! Thanks as always for your input. We have interests in 26-2N-6W, 2-1N-6W, 35-2N-6W and 11-1N-6W. Looks like we’re not affected by Gulfport’s plans? Thanks

My apologies…Martha.

1N-6W and 2N-6W do not have any current cases pending.

This topic was automatically closed after 90 days. New replies are no longer allowed.