I have wells in Weld county and get checks monthly from 3 companies. Junes checks were absolutely horrible, from all 3 companies. Does anyone have any idea why? Thank you.

Gas prices have dropped considerably since December. Oil prices have also dropped. Could be a combination of lower prices and natural production decline. Depending upon drilling and fracking nearby, your wells may have been briefly shut in to protect them during the frack.

Thank you for the information.

IMO its always a good idea each month to write down how much oil and gas each well made and what price you were paid. At least that way you know if volumes were up/down and how much you were paid per barrel or mcf. I just keep it in a spreadsheet.

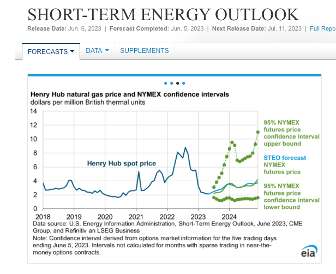

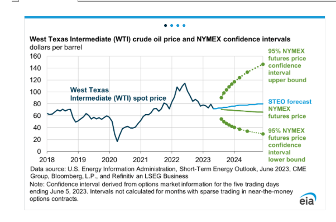

So if the check is high/low you know the root cause. Less volume, cruddy pricing, etc. I usually also compare the monthly oil/gas price to the average WTI and HHub prices for that month. (can find on EIA website, just google EIA WTI price history or EIA Henry Hub price history).

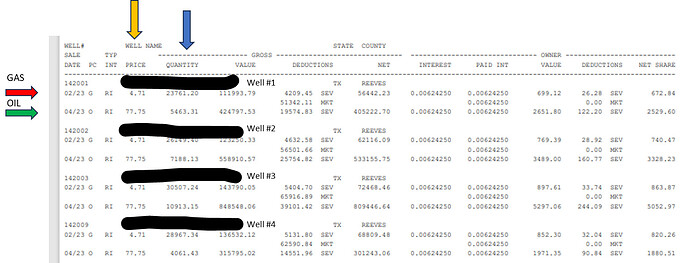

For example, here is a check. Yellow column is pricing. Blue column is the volume of oil/gas. Each well has a row for gas and for oil. In this example, well #1 made 5463 barrels of oil and 23761 mcf for this check. I can go to the EIA and see that for February 2023 the Henry Hub price for gas was $2.38 and I’m getting paid $4.71 for gas, so hooray for me (that is probably due to all of the liquids in the gas) and I can see that WTI for April was $79.45 and I got paid $77.75 so I’m getting a reasonable price for my oil. Unfortunately this isn’t my check as I’d love to make a few $ks a month but oh well.

Thank you, I will start doing that. I really appreciate your help!

After your question, I just checked my pricing/volumes for the last six months and the last checks were the lowest in a while. On the royalty stubs, oil is usually one month delayed and gas two months since it has to be processed and back calculated in most cases. My May oil prices were the lowest in many months and April gas prices were also the lowest in many, many months. Combined with normal production volume decline, it is what it is. Those months showed up on the June royalty checks. These graphs may help you see the trends and future outlooks. These are basic benchmark commodities. Your checks will vary due to local contracts, but tend to follow the same trends. 2022 was a highly unusual year due to COVID rebound and geopolitics. We are actually back in relatively more “normal” territory. Also note that gas has seasonal bumps due to winter storms and hurricanes.

Thank you, last summer I had record high checks and I sure hope they come back eventually.

Don’t count on seeing checks like last year. Last year’s high prices were an anomaly as you can see in the charts. Remember that your wells will naturally decrease in volume over time, so lower prices and lower volumes mean lower royalties.

This topic was automatically closed after 90 days. New replies are no longer allowed.