I know everyone has a different view of mineral ownership. For our family, we’ve always preferred to retain mineral rights and hand them down to the next generation. Some of the properties have been producing for over 100 years and I think that gives a unique connection to long gone family members, state history and the current economy. I’m not in any way opposed to selling mineral rights but we’ve always chosen not to. However, at some point, our children, their children or someone may decide that’s the best financial decision for them. I’m currently documenting a lot of things for our own descendants to hopefully help them make the best decision for themselves. One thing I’ve never gotten a handle on is a quantitative way to determine the potential future production of a property. I currently rely on nearby activity, permits issued and historical production. Are there better ways to determine potential production for an area 10 years into the future? Knowing things like capacity of oil available, limitations of current technology that may be solved and depletion by surrounding (and unowned) wells would be helpful things to know. We own rights in about 25 different TX and OK counties, some of which are in productive areas, some aren’t. I’d be interested to hear opinions of others and if this is something I should even worry about, or if I should just tell our descendants to hold on and see what happens.

This is a very good post! I think the same way you do about mineral rights and royalty. There are many different formations, technology is getting better, prices usually go up, laws change for the better and for the worst, taxes will always be there. Time changes everything. I will almost “starve to death” before I sell any mineral rights1

Im older than most on here. Guess it comes from my dad as he would sell time to time, but Ive never looked at minerals with sentimental value. We have always kept a spreadsheet with offers on them and whenever oil prices are high (Id never sell when oil prices are $70 or below) and I get a big jump in an offer, more likely than not I sell. Most of the board will never sell, but Id rather take the large lump sum of money and invest it. My brother never sells, Ive told him for years he should and he finally got sick of me telling him to, so we sat down a few months ago and compared his interest in sections that I sold and he didnt over the last 15 years and the income that it brought in and lets just say hes now open to selling. The new horizontal drilling is hard to predict, the declines are steep and more times than not, you think you are getting 4-6 wells and you get 2 due to the results or lack thereof after the 2nd well.

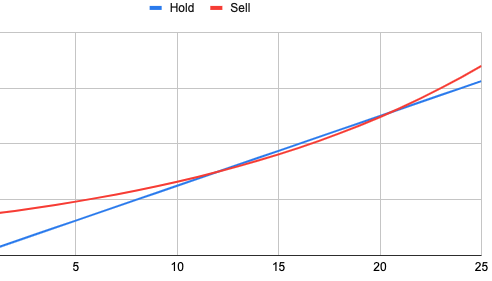

It’s not always cut and dried, is it? If you assume a 6X multiple on annual royalty revenue and a 6.5% return on investment income, you end up ahead for the first 10 years if you sell. From years 10-20, you are better off if you held and then from year 20 on, you’re better off if you had sold. Nothing is ever that static of course. Production won’t stay the same and a 6.5% investment return is a guess. The variables unknown are in potential production which is the same as any investment choice you make. I’m just hoping to arm my descendants with the right information to help them think through things.

For me the mineral rights are not about a dollar value. (we are so fractionated its hardly worth it) I cherish them because of the connection they have to the land that my great greats worked so hard on and struggled to pay for. I know… I’m an ole sentimental sap!

IMO, these are good posts (I mean what engineer doesn’t love a chart?), and yeah it’s never cut and dried.

I think you are thinking about it how I would think about it. It’s fairly easy to get a handle on the value of what is currently producing. It’s fairly difficult to get a handle on the value of what is currently not producing. Especially if you are not armed with easy organized access to offset activity and results. It’s about impossible to get a handle on the value of “I never ever saw that coming”, whether that be unconventional development (say looking at it from 2005 or something), or some nanobot technology that increases recovery, or just a huge transition away from oil.

On some level, if one sells they are giving away future payments for a lump sum up front. It’s just like taking out a mortgage. Just a far riskier, non constant payment mortgage. You get X today, you give up some multiple of X of payments down the road. Nobody really has an issue with taking out a 30 yr mortgage and paying 2.5X for X today. The logic in buying/selling is really the same.

I’m like Bob, I have a spreadsheet of offers. I normally cross reference it with oil price. From the spreadsheet of offers I have a list of people who are trying to buy minerals. Sometimes the offer will seem high enough (i.e. when oil prices are high) that I will engage with the person who made the offer. Have sold some. I don’t think I would ever sell without at least taking things to multiple folks.

I also get the sentimentality angle, it’s just in my family it applies to silly things like grandfather clocks and antique furniture and not that great art rather than minerals.

Cheers

Very good point. We as mere mortals cannot foresee the future. Some families want to tie up mineral interests making them virtually impossible to sell off. Certain situations dictate protecting the assets from beneficiaries with disabilities or foolish spending, etc. Sometimes it is protecting the individual with a substance or gambling problem from the assets. The point is planning is key.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Remember you don’t have to sell your entire interest. For example, if you have ten acres, you can sell five acres and retain the other five. I usually advise MO’s with large tracts, say 160 acres to do it this way so that the taxes don’t take half of what they receive.

This is helpful discussion, thank you. It’s made me realize that in addition to documenting things for our children, it warrants a discussion with them about balance between family asset and financial investment. Their sentimentality ranges from “doesn’t matter” to “cries at Safeway openings”. It would be hard to cover that in just a document.

That does not make any sense unless your goal is to reduce your income to stay out of the highest tax bracket. And the highest bracket only applies to the additional part of income, not to all the income. So the taxpayer is a net loser because he has less net income to spend or save. Keeping all 160 acres enables a mineral owner to be able to negotiate better, more favorable lease terms.

You are slowly depleting over time. You have to go on the offense and buy more to offset depletion or liquidate. Over time, your G&A/bbl will grow and hit a point wherein it will be uneconomic to own. This depleting inventory issue is the problem every oil company faces, hence why you see M&A.

Yes, this gets to the heart of my question. Individual wells deplete but improvements in technology and discovery also offset that. Predicting those in the future is difficult.

Also something to note is the role taxes play. If you produce out it’ll be taxed as passive ordinary income, so limited in deductions. If you sold, you’d pay capital gains which can be offset or even deferred all together.

Is your time better spent accounting for the producing properties and waiting for upside to come, if ever, or focusing that energy on your profession and what you enjoy doing?

There is upside cases in every asset class (stocks, real estate, etc…). To me, I enjoy dealing with the oil and gas properties so I’ve elected to continue on, however I know folks that have sold their interests to buy real estate, ranches, etc… just depends on how you want to enjoy your resources and time.

It all depends on how many horizontals have been drilled on your minerals. Best time to sell is when oil or natural gas prices are high and there havent been any horizontals drilled and youre getting high offers on upside. Once you get a few horizontals drilled, no matter the technology, you simply run out of formations/oil/gas to drill for the future thus making the minerals a depreciating asset.

Lost_Aggie,

First let me congratulate you on being a long suffering Aggie like myself. Tough weekend… tough year…

A few thoughts for your consideration.

(a) I’ll never sell the minerals in my family. just putting that out there for transparency. I agree with the comments about nostalgia and sentimental thoughts with respect to my family.

(b) the paperwork is the same whether your making $1 or $100 dollars a day. It definitely takes some work, and future generations may not want to mess with it.

(c) in answer to your question about valuation, the most accurate way would be to hire a petroleum engineer to assess the value. the simple way would be to do decline curve analysis on every well you have an interest in. next, pick an oil price to use and run a DCF analysis that yields NPV.

(d) wrt technology - yeah, I suppose this could be an issue going forward; but from my perspective most of the technology being brought to bear today is on new drills, not old drills. think about horizontal drilling and fracing as the primary 2 that have been impactful in the shale and tight space. nobody (very few folks) is going into old legacy fields that have been producing for a 100 years and spending the coin to drill a horizontal well. a quick look at the rig count shows almost 50% of rigs in permian, with the balance spread among other shale plays like Anadarko, DJ, Williston, Appalachia. virtually no one is drilling in south Arkansas which is where my family has a lot of minerals (bromine and lithium are a different story with respect to this Arkansas example…)

(e) there are a few options you should consider for managing your minerals. for transparency, I don’t work for any of these companies, and have not used all of these products. spreadsheets are an obvious choice that are used by many, including myself. other options are a few applications that are “on prem” like Pop’s or Roughneck, and others that are cloud based. these are typically subscription based and more expensive (MineralSoft, MineralWare); though there are a couple of free options with limited functionality (mineralIQ, energylink).

As others have said, the first thing you should continue to do is assess what you have. How to do that is for a different post.

Hope some of this is helpful,

David

Yes, the first thing I was told when I started at A&M was “don’t get your hopes up”. It’s made the last several decades easier.

Thank you for the very helpful post. I spent a lot of time creating an inventory with legal descriptions and I used MineralIQ among some other packages to keep track. That has been helpful. Easy ones like Wichita County have shallow wells that have been producing continuously since 1908! Midland County is the most challenging to me and where my biggest questions lie. There are horizontal wells being permitted and those are challenging to try to keep track of. I could rely on XTO, COG and Apache to keep track for me but I much prefer to have my own understanding, however feeble that may be.

I may look into hiring a PE to help assess the underlying value and estimate the depletion. I have no intention on selling anything but again, I’d like to document the process so my children can have the proper context.

Good for you in getting organized and leaving a legacy for your next generations.

Another thing to consider is that the current drilling is using current technology. The oil and gas industry has some of the best technical minds in the world and they are thinking decades ahead. Horizontals are in early innings in the game in my opinion (geologist with 45+ years in the business). Some areas are being tested for re-frac possibilities of early HZ wells, secondary recovery may be down the line, strategic infill drilling may come along, etc. etc.

Midland County is one of the easier places to estimate. Maybe that is just if you have the information. A lot of predictability. Lots of analogy. # of wells, zones that works, well production, etc. That is how it seems to me.

As far as A&M goes, Jimbo and $100m will be gone by 2031 and after that the sky is the limit.

Depends on what you do with the money. One should never say never. There are numerous investments you could make today that could be 10X, 50X. 500X 10, 20, 50 years down the road. Look back to technology stocks in the 80’s. You’d be way better off today IF you’d held them vs minerals, regardless of Horizontal development.

A couple of additional thoughts.

-

Diversification of net worth wins the day, most every day

-

Peak oil is coming. No idea when. But it is NOT the same ball game of holding carbon assets as it was for our parents and grandparents. The world has and continues to change in monumental ways.