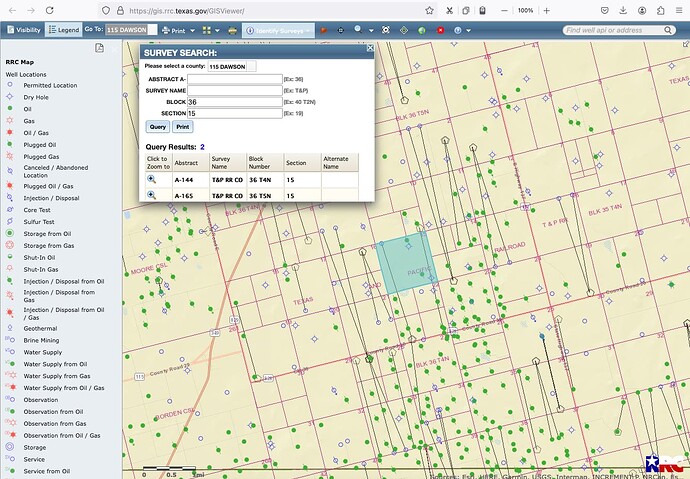

So my family owns mineral rights in Dawson County, specifically 26 acres in E/2 Sec 15, Blk 36 T4N. We have a horizontal pipeline going through our property which is tied to well Blue Beauty 15-22. We’ve had several offers to purchase the mineral rights and, without going into any details, we have a need to sell the rights. I’m just trying to get a general idea of the current value so that I can make sure that we fend of any low-ball offers or go to a mineral broker. I would greatly appreciate any help or guidance anyone is willing to provide.

Are you in Abstract A144? You probably should be getting royalties from the Blue Beuaty 15-22 horizontal well. There are permits for three section horizontal wells just to the east of you. Just filed by SM Energy. That is why you are getting offers.

The current offers are probably mostly for the value of your current well, but you have room for infill wells in your section. The buyers want the future royalties so they generally offer less in their first offer. So ask for more than what you are getting offered. You do not have to sell everything. You can sell part and keep part for cash now and cash later if they drill infill wells. I do not know the going rate in the area.

The Blue Beauty 15-22 well has produced 538,270 barrels of oil. The unit size is 640 acres. 26/640 = .040625 .040625 x .25 royalty = .01015625 .01015625 x 538,270 = 5467 barrels of oil 5467 x $70/bbl = $328,690 [$328,690 / 26 is close to $15,000 per acre] So, it seems possible your minerals might have paid out more than $300,000. If you have not received any royalties, it is possible $300,000 could be in a suspended funds account. And the well is still producing. Contact SM Energy in Denver, Colorado.

How many wells can your unit support? 2? 5? 10? More? And how many different producing horizons might eventually be found? Suggest you click on the Directories tab at the top of the home page and choose Mineral Services and consider reaching out to an attorney and/or to mineral management and mineral valuation companies. As M_Barnes said, you do not have to sell all of your minerals. And you might only sell the royalties off of the one existing well or get a loan via that one royalty stream so that you do not lose out on future drilling. To me, it would be an absolute must to proceed slowly and conduct any transactions through an attorney with whom I had a relationship as a client.

Yes, our property is in the lower South-East corner of Section 15 there. The pipe or horizontal well goes through out property. We have been getting royalties since 2021 when the Blue Beauty 15-22 started producing. We do have a lawyer looking into the offer, but I’m worried that we could get a lot more for the property that what the company has offered and what the lawyer suggested. Would it be worth reaching out to a Mineral Valuation company?

Thank you so much for the info. We received an offer for $250K but the company was estimating 39 acres versus the 24 that we actually own there. I’m just dipping my toes into all of this, so I’m just trying to get as much info/ammo I have to make a proper counter offer.

You first said 26 acres. If that was correct, and now somebody is saying 39 acres, my guess would be that we are talking about 26 mineral acres leased at 18.75% roy which would be 39 royalty acres.

A “royalty acre” being the amount of revenue ownership from a mineral acre leased at 1/8th royalty. Thus a mineral acre leased at 1/4 royalty would be two royalty acres. And a mineral acre leased at 3/16 royalty would be 1.5 royalty acres.

Just as a possibility. People making offers probably offer on a royalty acre basis.

This topic was automatically closed after 90 days. New replies are no longer allowed.