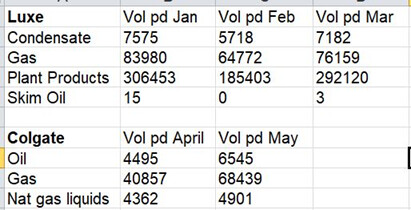

When I look at the Condensate disposition the numbers match what I was paid. When I look at the Gas disposition the numbers do not match. Can anyone tell me why that would be? Jan gas paid on 83,006 Volume Feb gas paid on 63,354 March Gas Paid on 76,159 April gas paid on 40,857 May gas paid on 68,439 June gas paid on 61,431 July gas paid on 60,163 August gas paid on 47,425 September gas paid on 43,974 Oct gas paid on 47,143

When I read your post I thought the answer to your question was probably “shrink”, the reduction in volume that takes places when gas is measured at the wellhead as production but is then sent to a gas processing plant where the natural gas liquids (NGL’s) are removed before the remaining residue gas is sold. But after looking at some other numbers reported on your well this seems to be more complicated. If that’s right you’ll probably have to contact Colgate’s Owner Relations section to get answers to your questions.

I’m guessing some of the variances you’ve seen between the disposition volume reported to RRC and what’s shown on your monthly royalty statements relate to things that happened when Luxe went through bankruptcy and was taken over by Colgate in June. It also looks like Luxe may have made a large correction, or reporting adjustment, that they lumped into the report they filed with RRC covering April, 2021 production.

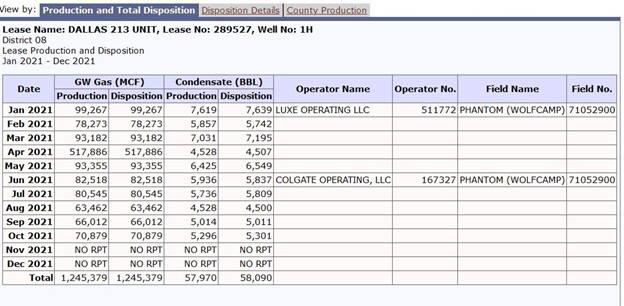

You included a copy of the RRC report in your post, but if you haven’t seen it look at the additional detail that’s shown on that same RRC report page. It’s under the second heading at the top of that page that’s marked “Disposition Details”. For example, if you look there at the breakdown Luxe reported for January, 2021 it shows the gross gas production volume of 99,267 MCF was split into three categories. Click the heading at the right side of that page marked “Disposition Codes” to see what those different categories mean. In January, Luxe reported that 8,381 MCF of the total became “separator extraction loss” (Code 9) when condensate was extracted. Another 974 MCF was reported as being vented or flared (Code 4), and the remaining 89,912 MCF was sent to a gas processing plant (Code 3). It looks like that sort of breakdown continued through June when Colgate became the operator and at that point the gas from this well was shown as Code 2 put in a transmission line rather than sent to a processing plant.

What Luxe reported in April is a mystery. They reported gross gas production to RRC for that month of 517,886 MCF, five times what the gas production had been in any of the previous months. At the same time the volume they showed under Code 9 as being separate out as condensate was even lower that month than was shown in that category in those three earlier months when the gas production was much lower. Luxe reported that 510,610 MCF of that large total April production volume went to a gas processing plant, but you said the monthly royalty statement for that month showed gas royalties you received were based on 40,857 MCF. The only explanation I can picture for those widely differing numbers would be a one time accounting adjustment that normally would have been detailed on the royalty statement.

Each month the operator files another report that shows sales figures you can compare with the numbers shown on your royalty statement. It is on the Texas Comptroller’s website called CONG https://mycpa.cpa.state.tx.us/cong/reportLeaseDropNGForward.do

For more information on how to access what you need on the Comptroller’s site go to the search feature (looking glass) at the top of this page and put in CONG and you’ll pull up previous discussions about using it.

Here’s a link to the latest CONG report for your lease. Reeves Co. - CONG - Dallas 213 Unit.pdf (776.7 KB)

On that report what Luxe reported to the Comptroller for the volume of gas sold from January through March, 2021 match the volumes they reported to RRC as being sent to a gas processing plant. But for the April production, rather than showing that large 510,610 MCF amount they report to RRC as going to gas processing what Luxe reported to the Comptroller repeated the same 85,448 MCF amount they had reported as sales in March. In May the numbers Luxe reported to RRC and on CONG again matched at 84,937 MCF, and from June on when Colgate was filing the reports for this lease the sales volumes matched on both sets of reports.

Except for the strange numbers Luxe reported for April production, the other differences between the volumes shown on those reports and your royalty statements might make be explainable as “shrink” if the royalties you have been received included payments for sales of natural gas liquids in addition to condensate and gas. Since the reports Luxe and now Colgate have filed with the Comptroller are only showing condensate and gas sales I’m assuming those are also the only type payments you have been receiving.

Try pointing out those differences in a letter to Colgate and they should be able to give you answers. I’d also try asking them about that big volume Luxe reported for April but they may take the position it isn’t their problem since that occurred before they took over from Luxe.

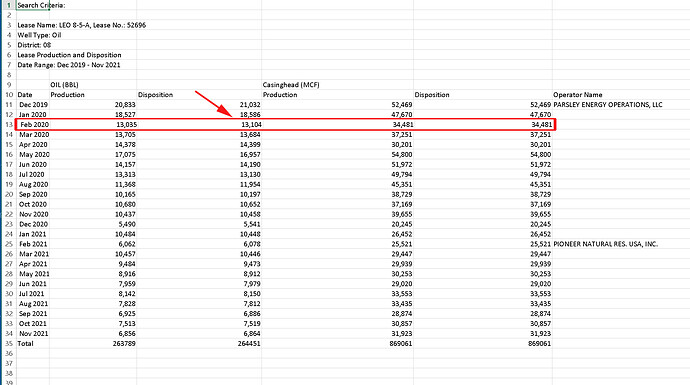

This is interesting, I looked at this same info for myself and now have the same question? My concern is this is an ORRI and not a WI. Would this make a difference? Why is there such a discrepancy in every one of these since 2019? Even in MCF for Jan 2020 vs the statement for Feb as I know MCF runs 30 days behind. I have asked this question of Pioneer in the past 45 days with no response.

Using Feb 2020 as an example.

Thanks for any input. MK

MK

I don’t think having a ORRI rather than royalty or working interest should make a difference on how the sales volumes reported to the State should match with the gross sales volumes shown on the monthly royalty statements you receive.

Probably won’t answer your questions but some thoughts on your other points: You mentioned the MCF (gas sales) numbers run 30 days behind. That’s true regarding when they appear on a monthly statement, but it doesn’t change the way the month’s volumes get reported to RRC and the Comptroller’s office. In other words, the volumes shown as January sales on those reports should be the volumes that were sold in January even if the report is dated March, and the oil sales shown on that same report were made in February. You need to be sure you are comparing the numbers reported for the same “production months”.

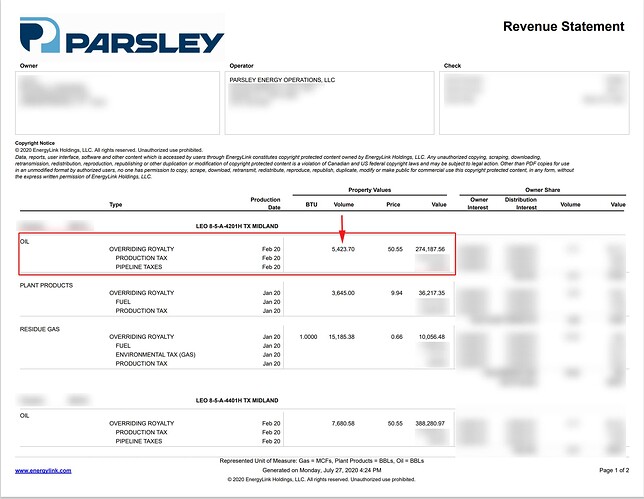

The RRC production report you posted showed the combined production from a lease that has two wells (4201H and 4401H). The part of the royalty statement you were comparing it to showed the oil, gas and NGL sale volumes for the 4201H and just the oil volume for the 4401H. I’m assuming you have a second page with the other volumes for the 4401H. To compare the volumes on your monthly royalty statements to the volumes Parsley/Pioneer reported to RRC the volumes the monthly statement shows for each well would need to be added together. Since that monthly statement showed some volumes for January and others for February, 2020, be sure to add the right months together. For example, if you add the 5423.70 barrels of oil that royalty statement shows as Feb, 2020 sales from the 4201H well to the 7680.58 it showed for the 4401H, the total of 13104 barrels matches the total shown for February on the RRC report you posted. Those volumes also match the sales volumes Parsley reported to CONG, the State Comptroller’s website. On the CONG reports the volumes are shown separately for each well and there are separate reports for gas and oil.

To make a comparison of the gas sales volumes, go back to the RRC report you posted and look at the additional breakdown shown under “Disposition Details”. For January, 2020 that detail shows 46,003 MCF out of the combined January production from the two wells was sent to a gas processing plant. The report Parsley filed for that month on CONG shows the volume from each well separately but added together they match the total shown on the RRC report. On CONG the reports are filed based on the drilling permit number for each well. Here’s a link to what you’d see if you pull up the gas reports on both wells for January, 2020 and the oil sales reported for January and February, 2020. There’s a check by the permit number to use if you want to see what was filed for other months. Ward Co. - Leo 8-5-A 4401 H and 4201.pdf (1.3 MB)

Comparing these reports, in Jan. 2020 the 4201H sent 21,388 MCF to a gas plant for processing and the 4401H well sent 24,615 MCF. That’s a combined total of 46,003 that matches the total amount shown on the detailed RRC report for that month. The royalty statement you posted showed gas sales from the 4201H of 15,185 MCF in January, 2020 which indicates the shrink in volume was about 30% when it was processed and the NGL’s were removed from the original 21,388 MCF amount. For the 4401H you can compare the gas sales volume of 24,615 MCF shown on CONG to what your royalty statement shows. If it follows the same pattern as the other well a 30% shrink would make the after processing volume from that well about 17,250 MCF.

The other thing you may wonder about when you compare the sales revenues that were reported to CONG to the total sales revenues shown on your monthly statement is why the oil numbers for each well match exactly but the gas numbers are widely different. Maybe someone else will share some ideas on it, otherwise you might try asking Pioneer about that.

@Dusty1 ,

Thank you very much for clearing that up for me. What you say makes total sense now when looking at the whole vs the individual. Very much appreciated. I will go back and verify the statements vs RRC again. ![]() MK

MK

Many companies, such as Pioneer above, separately report sales for the “dry” gas at the tailgate of the plant as the gas volume and the liquids / plant products volumes on the check. The reported gas volume is the remaining or residue mcf after processing and removal of the liquids. Other companies will report the combined sales revenues of residue gas and liquids as a single line and use the total gas volume that went into the pipeline. Most companies combine the residue gas and liquids sales in reporting to the Texas Comptroller on the CONG. For total comparison, you should look at the sales dollars reported to the CONG and compare to the combined sales revenues for gas and plant products on your check.

Thank you! I appreciate your time for the detailed explanation. I got my last check from Luxe in May, didn’t receive a check in June, received a check from Colgate in July paying me for April and May for gas and natural gas liquids, and May for oil. There were no adjustments on the Colgate check that would explain that large 510,610 MCF amount that was reported to RRC. The check dated April from Luxe also didn’t show any adjustments. So I will see what I can find out.

I looked at the Gas Well and Condensate codes you mentioned. From their descriptions, it would seem that I wouldn’t get paid for Code 1 (lease or field fuel use), Code 4 (vented or flared), Code 9 (separation extraction loss). Is that correct? So that leaves code 3 that Luxe used and code 2 that Colgate uses. Is this what I should get paid on? How does the different coding between Luxe and Colgate affect what I am paid?

Below are the categories I got paid on per production date not check date. Is it even possible to verify the gas volume that I got paid for? If shrinkage plays a part, am I to assume my numbers will never match what’s reported to RRC?

Debra

Whether you are paid for gas marked Code 1 (lease fuel use) may depend on your lease or the operator’s practice, and when paid the price is usually a fraction of market. Code 4 flared or vented gas typically isn’t paid for. There are leases with special provision added that require it but it’s unusual. Code 9 isn’t paid for as gas because that volume ended up being included in the volume of condensate you are paid for.

Whether it will make a difference that Luxe showed the remaining gas volume under Code 3 and Colgate uses Code 2 is hard to say. It may not really reflect a change on what is happening, just a difference in how each one reports it. Like TennisDaze said earlier the way the numbers are reported varies company to company. If you are still being paid for NGL’s that indicates the gas is being processed.

If the numbers in your last post were the sales volumes from your monthly statements, all the condensate numbers match RRC and CONG. I don’t know a way to make a comparison on plant liquid or NGL volumes because they aren’t reported to the State by well or lease. I’m guessing the NGL numbers you showed for Colgate were measured in barrels and the plant products numbers for Luxe, that are the same thing, were shown in gallons. Multiply those Colgate numbers by 42 and you’ll see how all those months track with the equivalent month gas volumes.

On your question about the gas sales volumes, you can’t directly match the volumes on your royalty statement to the pre-processed volumes shown on the RRC and CONG reports. The operator has monthly reports that would allow that comparison but they aren’t public information. You should still be able to get a pretty good idea if the numbers on your royalty statement are in the ballpark, or something occurred like in April, 2020 that justifies questioning. From January through March the numbers you posted from your statements ran 7 to 11% below the pre-processed volumes reported to the State those same months which seems like a fairly low shrink factor. In April the volume on your statement and what was reported on CONG were much further apart, but still didn’t approximate the much bigger difference between both those numbers and the volume Luxe reported to RRC under Code 3 that month. In May each set of numbers were back in line, but the difference due to what I’m assuming is processing shrink ran more like 20%. If you’ll make that comparison in later months you should be able to get a feel for a normal difference between those sets of numbers and judge when something looks out of line. Trying to follow the numbers that way can be frustrating but unless you are a working interest or large enough royalty owner to include audit rights in your lease it’s the only alternative.

Thank you again! So much to learn, it is a little overwhelming. So I appreciate the detail in your explanation.

This topic was automatically closed after 90 days. New replies are no longer allowed.