I have a question from a client that I’m not able to find the answer for…and this particular dark rabbit hole of law for Oklahoma revenue payments outside of my expertise. But maybe someone here has some knowledge to share!

And, no, I’m not billing said client for this time/question; it’s all pro bono (And to my dear client, feel free to chime in if you see this and would like to, since you’ll know this is you ![]() )

)

This mineral owner has wells in Oklahoma which had a change of operator. The past operator paid on NGLs and Dry Gas, but the new (small) operator only pays on Wet Gas. That’s fine, except there wasn’t much of a bump in BTUs (when there should have been a significant one) and the revenue statement didn’t list the BTU factor of the gas, so we asked for clarification. The operator provided a plant statement showing the gas volume matching the wellhead gas (aka, wet gas). Except the plant statement also showed the gas was being processed for NGLs, and the operator blanked out the pricing of the products and dry gas.

Is this allowed? I’m questioning how they determine the price to pay per mcf or per mmbtu since the statement would only show settlement price for dry gas and plant products. The operator hasn’t responded yet. I’m sure they could be combining the revenue and backing into $/mcf…but boy…that seems more complicated rather than less. I had assumed the operator/lessee would need to pass along revenue in the same manner in which they received revenue, especially when the lease didn’t get fancy and specify some alternate method.

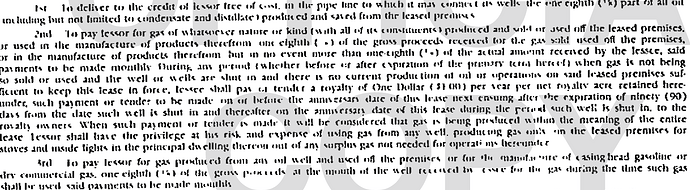

It’s a typical older lease (“form 88” from 1995) without much language around NGLs. It’s also hard to read, but here’s the royalty terms: