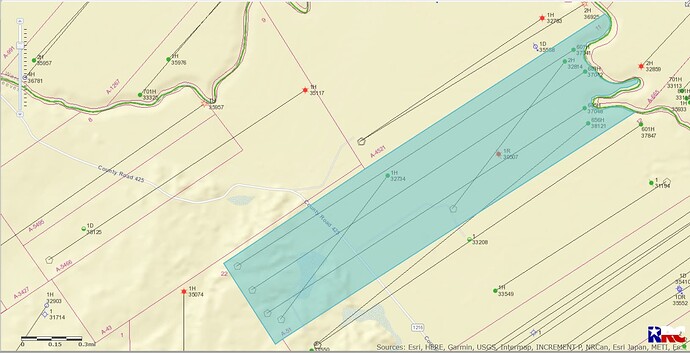

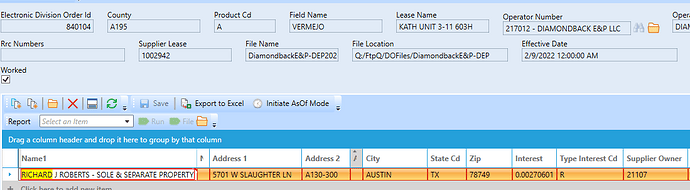

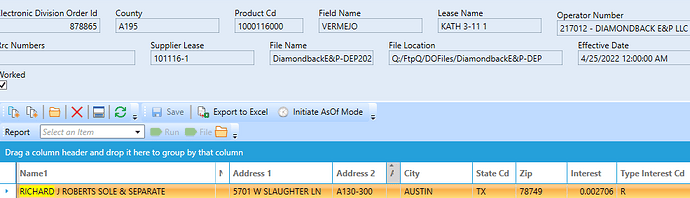

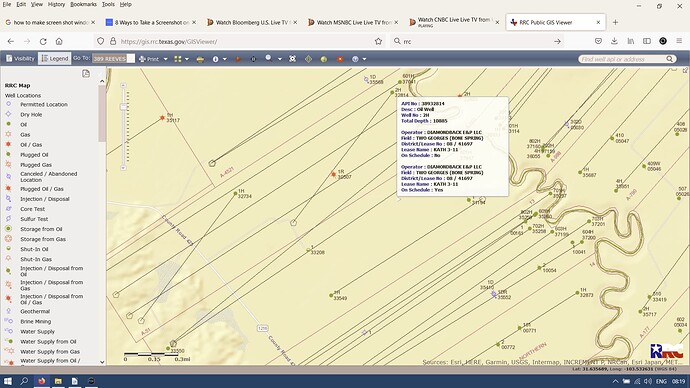

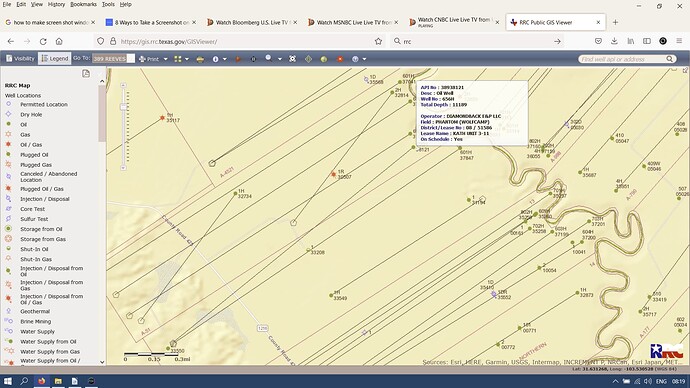

CAGI has been very helpful to further explain my property identification questions. they get their info from RRC and were able to look very quickly into well and account info. what i learned is that each set of wells within a pooled field gets their own lease number internal to the RRC. that number can be found on the tax bill in the legal description. it looks like this: ‘Unit Name’ 800xxxxx-000 where the x’s are the lease number. my example: kath 3-11 [unit name] 80041697 where 41697 is the RRC lease number associated with this unit and field.

so there are two fields where i have minerals and all wells within each of those two fields are lumped under the same lease number and have their own unit name. in my case what had been confusing me is the two unit names aren’t so different from each other as to seem they might be the same but now i know they are not.

what i have really been trying to find out is how to read the supplemental tax statements recently received from the reeves county assessor and the unit names (being so similar) were confusing me and there was not date information.

it was also confusing because one well in one of the units had quit producing and i could not tell from the tax statements if that had been taken into account and that is when i learned production from all wells within a unit are lumped undifferentiated into one account for tax assessment purposes. anyway, i understand now.

regarding the tax statements, apparently the appraisal office had not sent them out in some instances for 2020 and 2021 and now they are playing catch up which is why the numbers are so big - they represent multiple years. they have to be paid at once by end of this august or heavy fees and penalties are applied - seriously heavy.

i called assessor office to ask if there might be a payment plan and they said it would be ‘ok’ to pay them over time but penalty and interest would be applied.

this time CAGI could not have been more helpful. in my case, additionally, there was a clerical error [DOI error, thx TennisDaze] in adding the last drilled well into the lease pool which resulted in a mislabeling of its legal description in the tax documents; CAGI checked it out with RRC records and took care of it immediately in the database for my account which automatically updates it in reeves co tax ofc records; super impressive.

regarding the fields’ names being incorrect, together we determined it was from the operator reporting the wrong field for my wells in data sent to CAGI and, should i want to, that would have to be taken up with the operator. not so important because CAGI caught it on their end thru their computer apps because they draw most directly from original RRC data and not so much on info from the operator - i understand the process much better and i can understand the tax statement much better now.

i think the way these taxes are calculated - CAGI takes the average of the bbl price from the previous calendar year and multiplies it with the amt of bbls to come off your wells during the year to get total income from the lease for the year then multiplies by your fraction of ownership to get what you received for the year and multiplies that by the tax rate and sends you a bill. what i did not understand in the explanation is whether there is a decline curve factor applied to their valuation during calculation.

CAGI is not able to change valuation but only find errors. i think these tax rates are too high . . . am i correct in that reeves co is taking near a tenth of the annual production revenue generated? but don’t bother to argue with CAGI because they do not set the tax rates.

fortunately, in a perverse way, the two years in arrears we (me) are being billed now in the supplemental tax statement were low income bbl years (think pandemic and russia-saudi pumping war) so this surprise supplemental larger than normal lump tax is ‘doable’ for me. next year’s taxes will be high because they will be based on this year’s income and $/bbl has been high this year. conclusion, i’m going to begin setting back now for these taxes for next year.

thanks forum for helping me get my minerals paper trail better understood. for anyone who called CAGI and did not really get all their questions answered and found them somewhat aloof, i suggest to gather your docs and well data to have in front of you and call again. cheers.