xxx

E,

In order to give you an accurate assessment I would need some more specific information, especially what Block/Section/Township/Range (legal description) the interest is in. I have worked with a number of mineral owners who own interest in Midland County, TX like yourself and would be happy to help you in any capacity I can. I can help answer your questions as well as find you additional offers for your mineral interest. Please feel free to call me at 713-569-4171 or email me at samuelslandman@gmail.com if you would like to discuss this further.

Ben Samuels Landman Midland, TX

I just sold 27 net mineral acres in Section 42 with approximate 3/16 average royalty leases for $654K. This was 1 1/2 to 2 times more than anyone else had offered. Very hot area right now.

Mr. Lowrey,

My advice would be to post the legal description so that members of the forum can give you public advice about the minerals and what is going on around your location. Midland County is a great area to own minerals, and I've seen lease bonuses that significantly exceed what you're being offered to sell the minerals, so I would definitely proceed with caution.

If I were in your shoes, I would be hesitant to sell the minerals, but if you do want to sell, you should try to get a good feel for what exactly it is that you own. It is possible some of your depths are not currently subject to a lease, and you could lease the open depths for more than your purchase offer.

You may also consider reaching out to one of the forum sponsors to see what prices they're seeing in your area. http://marketplace.mineralrightsforum.com/ad-category/minerals-mana...

Best of luck!

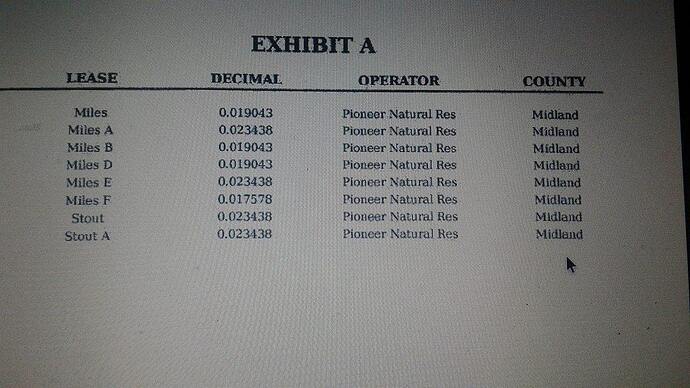

That is right in the middle of Pioneer's big development area. Below is a screenshot from the Texas Railroad Commission's GIS viewer showing the activity in the area. The dark lines connected to hollow circles represent drilling permits that have been issued for horizontal oil wells. You'll note a few permits that touch the top portion of Section 25, but those are just surface locations for the wells being drilled to the north of you, so you would likely not receive royalties from those. Nevertheless, it is an extremely active area. Assuming your minerals aren't burdened by a large number of non-participating royalty interests, there is no way that I'd sell 56 NMA for $600k in that area. There is also a small amount of production in the NE/4 from an old vertical oil well. Are you currently receiving royalty checks? If not, you may have money held in suspense with the operator (Pioneer).

Getting a mineral attorney will assure you of having a protective Purchase and Sale Agreement with proven title. Good thinking. What a legitimate buyer may pay depends on an analysis of the geologic potential of the parcel then demanding a fair price that satisfies the sellers needs. Initial offers are generally a fraction of the true geologic worth per acre and based on inflated acres to be discounted later after a seller signs up.

With 56 net minerals acres (if tat is known to be true) you will be well off to get your acreage and title appraised so you can make the best deal for you possible. An appraisal of reserves and potential has already been done by the offerer. If you as a seller don't educate yourself as to the options, you are at a distinct disadvantage in negotiating a fair price.

A consultant can also help you understand the many transaction options that may better suit you. They go far beyond the decision to sell or hold. An experienced ally can also find out if you have the rights to more than you were deeded. are obviously in a sellers market. Take your time and make the most of it. Experts in any business add value to transactions. In my experience that value can be 2.5 - 6 times the first offers.

Gary L Hutchinson

Minerals Managment

The current income is a drop in the bucket compared to what horizontal development would produce. The section to the north of you contains 10 horizontal drilling permits. If that was your section, your offer would be multiples higher than what it is, as the mineral buyers would have the reasonable expectation of receiving their money back and profiting within a very short term.

If you want to hedge your bet, you could sell half and retain half, but if you're going to go that route, I would be methodical and take your time to learn about your current lease terms, what your ownership/title looks like, etc... At that point, you will be in a better position when negotiating with buyers. There are dozens of mineral buyers that would love to have acreage in that area, and I don't foresee the prices dropping anytime soon... As I noted previously, you could try reaching out to the sponsors to see what they think about prices in that general area, but regardless of what they say, that is very valuable rock. I'd also suggest you read some of Pioneer's investor relation presentations on their website to learn more about what they think of the area.