I thought I had a pretty good grasp on my statements I receive from Apache. I am starting to think I don’t. Well I know I don’t. Is there a resource out there that can give me a lesson on reading the thing? I think I would be waiting forever to review it with Apache. Guessing one of those entities that have been trying to buy my minerals might help, but there is a trust issue there.

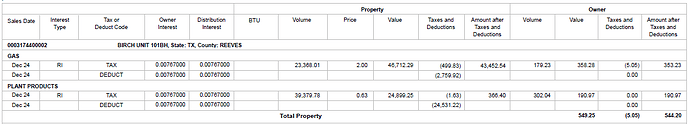

If you want to post a few lines with the headers (do not give any personal information or black it out), we can walk you through it. Most statements will have a well or lease name with an internal property code, product, dates or production, Gross Columns (Property Values) first with BTU, Volume Price Gross Value minus deducts (usually for gas post production changes and taxes), then your Owner Share columns with your Owner Interest, Distribution Interest, Volume and your final net value of royalties. I am looking at an old Apache statement from 2020, so not sure if they have changed the format.

I appreciate your interest. I was kind of caught off guard by how small it was even though NG prices were way up as compared to previous statements. I am guessing Value is total value for the well as opposed to owner interest value.

The first Value under Property is the Operator’s Gross Value before deducts which follow. The second Value to the right under the Owner is your Gross Value before deducts. The last column is your owner final royalty after deducts.

Note that the production date is Dec. The price that is listed is the contract price your operator gets when they sell. It may not be close to the WTI that you see posted elsewhere.

Are the values here all per my owner interest? For instance volume at 23K with a price of 2.00 generates the 46,712, minus roughly 500 for taxes comes to the 43K (amount after taxes). Does the, under owner, volume reflect the property volume with the owner interest taken into consideration. Same with value? Our prices are from Waha, which are kind of rough to ascertain except either with a report membership or it happens to be referenced in the EIA roundup, which is frequently what I check. The $2 price roughly matches what I was seeing for much of that month. One question, since apache had to pay to take away the NG for many of the last several months, where would I see that “charge back,” for lack of a better term. I am guessing the owners are responsible for positive and negative pricing. I will note, the volume on this report (this month’s) is about 20x the volume from the September 2024 report for the same well, when pricing was .24.

Multiply the Property (aka the Operator) Volume by the Owner (aka you) decimal and you will get the Owner volume. Same with Value. The Operator is paying for the deducts, but you are not. You will probably not see the behind the scenes accounting. The OPERATOR, not the owner is responsible for their own contracts. They are at the mercy of the pipelines rates. You, the owner, are just down the food chain and have no control over the positive or negative pricing.

This topic was automatically closed after 90 days. New replies are no longer allowed.